CBPE Announces First and Final Close of CBPE Fund XI at its £714m Hard Cap

CBPE announces the first and final close of its latest fund, CBPE Fund XI at its hard cap of £714 million. The fundraise was significantly oversubscribed, resulting in a first and final close within four months of launch.

Rede celebrates LA office opening with Rede West Coast launch party

Last week, we held our official Rede West Coast office launch party to celebrate the opening of our new location in Los Angeles.

Rede Partner Kristina Widegren joins as a panelist for Hayfin’s International Women’s Day event

Rede Partner Kristina Widegren recently joined as a panelist as part of Hayfin’s Global Women’s Initiative’s annual International Women’s Day event.

Rede CEO Adam Turtle visits the Influencers Fireside Chat podcast to discuss critical insights on evolving trends in private equity

Rede CEO Adam Turtle sat down with Giovanni Amodeo for the Influencers Fireside Chat podcast from ION Analytics to discuss the critical insights on evolving trends in private equity, fundraising strategies, and the dynamic GP-LP landscape.

Gabrielle Joseph, Rede's Managing Director & Head of Due Diligence and Client Development, speaks Preqin to discuss the evolving advisory role of placement agents (Copy)

Gabrielle Joseph, Rede's Managing Director & Head of Due Diligence and Client Development, spoke with Shaun Beaney at Preqin on why the advisory role of placement agents has become even more strategic – and truly global.

Rede Partners celebrates International Women’s Day with stories and questions from women leaders across the firm

At Rede Partners, we are proud to celebrate International Women's Day. Today, and every day, we recognize the incredible contributions of women around the world, and especially within our team - which is made up of 50% women.

Rede Partners named Placement Agent of the Year in EMEA at the Private Equity International Awards 2024

Rede Partners has been named Placement Agent of the Year in EMEA at the Private Equity International Awards 2024!

Rede Principal Aleksandra Putra speaks for French BFM Business show to discuss private equity trends

Watch the full video here.

Rede holds its annual IR Lunch in London with speakers Rede CEO Adam Turtle and special guest speaker Marina Hyde

Last week, we held our annual IR Lunch in London. We were delighted to see such a great turnout of guests, clients, and non-clients alike.

Alchemy Partners announces final close of Alchemy Special Opportunities Fund V at €1bn surpassing its fundraising target

Alchemy Partners announces the successful final close of its latest Special Opportunities Fund, Alchemy Special Opportunities Fund. Alchemy surpassed its fundraising target, securing €1bn in total capital commitments, highlighting strong investor confidence in Alchemy’s investment strategy targeting European mid-market corporate special situations.

Nordic Capital announces First and Final close of Evolution II at EUR 2 billion hard cap after rapid four month fundraise

Nordic Capital has announced the First and Final close of Nordic Capital Evolution II at its hard cap of EUR 2 billion. Closed within four months from launch with excess demand, the Fund significantly exceeded its target of EUR 1.4 billion.

Rede’s 2024 year in review: a highlight of our journey

As 2024 comes to a close, we at Rede wanted to share our successes and highlights. Thank you for your continued trust and support. We appreciate you being part of our journey.

Rede alliance partner Greater Share announces successful close of its first Education Fund

Greater Share, an innovative philanthropic investment platform connecting the world’s top-performing private equity funds with high-impact NGOs, announced the successful final close of its Education Fund (“the Fund”) at $52 million.

AshGrove Capital Closes Fund II At €650 Million Hard Cap, More Than Doubling Fund Size

AshGrove Capital, an independent pan-European specialty lender, announced the final close of AshGrove Specialty Lending Fund II at the hard cap of €650 million, surpassing its target of €500 million.

Rede wins Placement Agent of the Year at the 2024 Alternative Credit Awards

We were honoured to win Placement Agent of the Year at the 2024 Alternative Credit Investor Awards last night in London! Congratulations to all the other winners and to those nominated. Our future is bright!

Verdane closes Idun II at €700 million hard cap to back companies that will create a more sustainable future

Verdane, the European specialist growth investor, has announced the successful final close of Verdane Idun II at its €700 million hard cap, more than double the size of its €300 million predecessor Idun I.

Inverness Graham Closes Inaugural Green Light Fund Above Target at $238m

Inverness Graham (“IGI”), a Philadelphia-based buyout firm, announced the final close of the Inverness Graham Green Light Fund at $238 million, exceeding its $200 million target.

BlackFin Capital Partners closes Europe’s largest ever buyout fund dedicated to asset-light financial services at €1.8 billion

Driven by strong demand from institutional investors in Europe (45%), the Americas (45%) and Asia (10%), the new fund size significantly exceeded its €1.5 billion target and represents an 80% increase on its €985m predecessor Fund III.

LPs Target Top Talent as They Boost Support for Emerging Managers

Rede Partners announces the results of its Emerging Manager Survey conducted in September 2024. This research surveyed 68 of the most active, predominantly US based, Limited Partners (LPs) investing in emerging managers, offering insights into the current fundraising landscape and investor expectations. Emerging Managers are defined as GPs between Fund I-III and less than US$1bn in fund size.

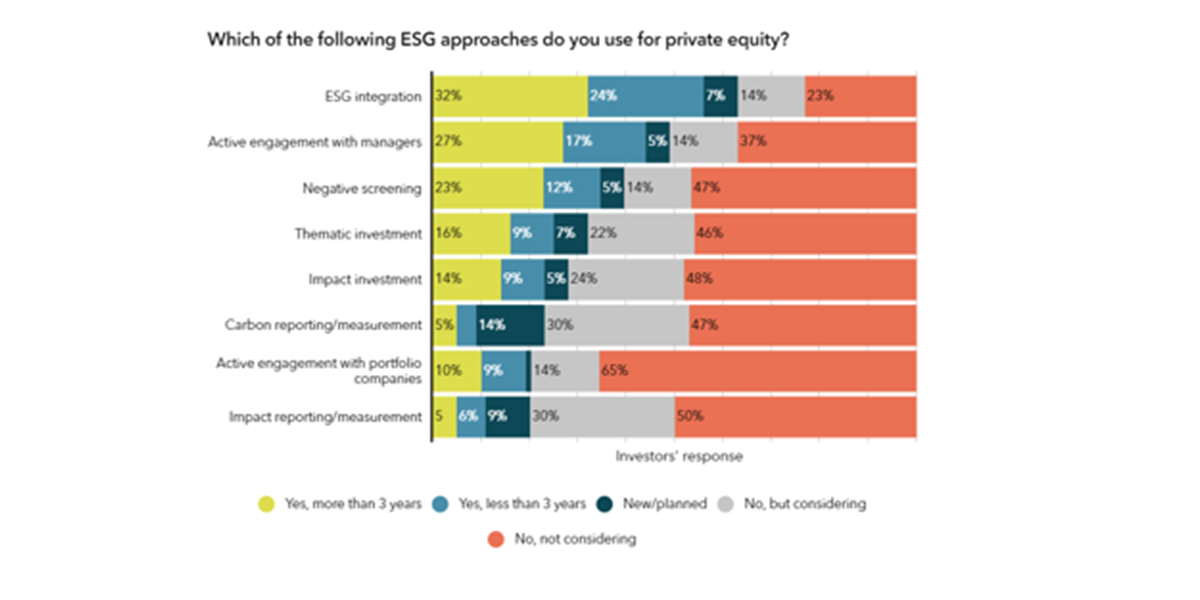

Private Markets Sustainability and Impact Report 2024

Rede Partners is delighted to publish our Private Markets Sustainability and Impact Report, monitoring and analysing institutional investor (or Limited Partner, “LP”) sentiment towards climate, Sustainability and Impact investing.

Rede wins Placement Agent of the Year at the 2024 Mergermarket British Private Equity Awards

We were honoured to win Placement Agent of the Year at the 2024 Mergermarket British Private Equity Awards earlier this week in London. Members of the Rede team were on hand to accept this prestigious award.

Miura Partners closes over €800 million in 2024, one of the largest dedicated pools of capital for supporting Iberian businesses

Miura Partners, a purpose-driven Iberian mid-market investor, has announced final closes of three funds raising over €800 million in aggregate. Miura Fund IV closed at its hard cap of €475 million. A further €135 million was raised for Miura Impact Fund, the firm’s first vehicle fully dedicated to Impact. €200 million was also secured for Dent&Co, a continuation fund in the dental healthcare space.

Rede announces five new appointments and promotions, as well as plans to open an office in the Middle East

We are pleased to announce two promotions to Partner from our global coverage network, as well as three senior hires adding important capabilities to the firm.

Rede CEO Adam Turtle Speaks to Tom Mackenzie for Bloomberg’s flagship morning show The Pulse

Watch the full video here.

Partner Kristina Widegren named one of Twenty Trailblazing Women of 2024

Since joining Rede in 2013, Kristina has worked on 80 fund closes, helping to raise over €120bn and repeatedly delivered outstanding outcomes for our clients.

Volpi Capital closes Fund III at €428m

Volpi Capital LLP, a specialist technology investor in the European lower mid-market, holds its final close of Volpi Capital Investments III at €428 million.

PUBLICATION: Rede Liquidity Index 1H 2024

Welcome to the 13th edition of the Rede Liquidity Index (RLI), looking at institutional investor sentiment towards Private Equity (“PE”) in the first half of 2024. The latest data shows a five-point uptick in LPs’ intention to allocate more capital to Private Equity funds resulting in an overall RLI score of 54 in the first half of the year.

PUBLICATION: NAVigating NAV Financing: LP perception survey and lender market report

We are delighted to publish our latest NAV Financing Market Report 2024. Last year, Rede published our first NAV Financing Report, which was based on proprietary research conducted with NAV lending counterparties and provided market insights and data from a lender perspective. This year, our focus is on the perceptions and sentiments of Limited Partners toward NAV financings, drawing on data and investor commentary from Rede’s 2024 Limited Partner Perception Survey.

Apiary Capital Fund II closes above target at £240m

Apiary Capital, a specialised investor focused on lower mid-market UK services, has held a final close of Apiary Capital Partners II substantially above its £200m target at £240m.

Rede Partners appoints Riccardo Villa as Head of Strategic Capital Advisory

Riccardo joins with 20 years of experience from Lazard to deepen Rede’s capabilities in supporting its clients to build their franchises through accessing capital at both the portfolio and corporate level.

Avista Healthcare Partners VI closes on $1.5 billion

Avista Healthcare Partners VI closes on $1.5 billion

Verdane closes Edda III past target at €1.1 billion

Verdane closes Edda III past target at €1.1 billion

TJC closes oversubscribed $6.85 billion Resolute Fund VI above its original hard cap

TJC closes oversubscribed $6.85 billion Resolute Fund VI above its original hard cap

PUBLICATION: Rede Liquidity Index 2H 2023 Report

We are pleased to announce the publication of the 12th edition of the Rede Liquidity Index (RLI), looking at institutional investor sentiment toward private equity fundraising in 2023 and expectations for 2024.

Jeremy Smith recognised as one of New Private Markets' 50 Influencers in Sustainable Private Markets

Congratulations to Jeremy Smith for being recognised as one of New Private Markets' 50 Influencers in Sustainable Private Markets.

Vidia Equity closes oversubscribed Climate Fund I at €415 million hard cap

Vidia Equity closes oversubscribed Climate Fund I at €415 million hard cap

Rede Partners announces new strategic alliance with Greater Share

Rede Partners announces new strategic alliance with Greater Share

Ara Partners announces the close of Ara Fund III at increased hard cap

Ara Partners closes over $3bn of new capital commitments

Adam Turtle, Rede's Senior Partner and CEO, named one of the Fifty Most Influential 2023 by Private Equity News

Adam Turtle, Rede’s Senior Partner and CEO, named one of the Firty Most Influential 2023 by Private Equity News.

Rede Partners featured in Real Deals Future 40: Climate Change Champion List

Rede Partners named by Real Deals for pioneering role in raising over $6 billion for impact managers.

PAI Partners raises €7.1 billion for eighth flagship fund

PAI Partners raises €7.1 billion for eighth flagship fund

Verdane closes oversubscribed Capital XI at €1.1 billion hard cap

Verdane closes oversubscribed Capital XI at €1.1 billion hard cap

Angeles Equity Partners announces the close of Angeles Equity Partners II, L.P.

Angeles Equity Partners announces the close of Angeles Equity Partners II, L.P.

Volpi Capital announces the close of Volpi Capital Investments Conti LP

Volpi Capital announces the close of Volpi Capital Investments Conti LP, a continuation vehicle purchasing the remaining interests in Volpi’s 2016-vintage debut fund.

PUBLICATION: Rede Liquidity Index 1H 2023 Report

We are pleased to announce the publication of the 11th edition of the Rede Liquidity Index (RLI), looking at institutional investor sentiment toward private equity fundraising in 2023.

Rede named Fundraising Adviser of the Year at The Drawdown Awards 2023

We are proud to have been awarded Fundraising Adviser Of The Year at The Drawdown Awards 2023.

PUBLICATION: Rede Partners NAV Financing Market Report 2022/23

We are delighted to publish the Rede Partners NAV Financing Market Report, our latest white paper based on Rede’s proprietary research and market insights.

Wise Equity closes Wisequity VI at €400m hard cap

Wise Equity SGR has announced the closing of Wisequity VI at €400 million.

James Varela recognised in Private Equity International's Future 40 Leaders 2023

We're delighted that James Varela, Principal, has been named in Private Equity International's 'Future 40 Leaders 2023'.

VIDEO: Rede Private Markets Sustainability and Impact Report

We are delighted to publish the Rede Partners Private Markets Sustainability and Impact Report, looking at institutional investor sentiment towards Sustainability and Impact Investment in private equity.

Paragon Partners raises €1.2 billion for Fund IV

Munich-based Paragon Partners has raised €1.2 billion in capital commitments for Paragon Fund IV (P4), representing a 50% increase from the predecessor fund, Paragon Fund III, which closed on €783m in 2019.

Bencis announces closing of Bencis IV Continuation Fund

Bencis Capital Partners B.V. is pleased to announce the closing of Bencis IV Continuation Fund.

PUBLICATION: Rede Partners Private Markets Sustainability and Impact Report

We are delighted to publish the Rede Partners Private Markets Sustainability and Impact Report, looking at institutional investor sentiment towards Sustainability and Impact Investment in private equity.

Longship closes third fund at NOK 2.1 billion hard cap in under four months

Norway-based private equity firm Longship has announced the first and final close of its third fund, Longship Fund III, at NOK 2.1 billion (c.€200 million).

Monterro announces final close of Monterro G1 at €150m hard cap

Monterro, a leading Nordic B2B software investor, has announced the final close of Monterro G1 at its €150m hard cap, including a 24% GP commitment. The Fund was oversubscribed and raised entirely from existing investors.

Rede Partners launches LP portal RedeWire

Rede Partners has launched RedeWire, an interactive portal for institutional investors.

Rede announces fourth global location with opening of Amsterdam office

Rede Partners is delighted to announce that it has opened a new office in Amsterdam, The Netherlands, to strengthen its European footprint.

Rede passes twin milestones of €100 billion raised and 100 team members

Thanks to your support, Rede Partners has reached some momentous milestones during 2022.

PUBLICATION: Rede Liquidity Index 2H 2022 Report

We are pleased to announce the publication of the 10th edition of the Rede Liquidity Index (RLI), looking at institutional investor sentiment toward private equity fundraising in 2022/23.

VIDEO: Rede Liquidity Index 2H 2022 Key Findings

We are pleased to announce the publication of the 10th edition of the Rede Liquidity Index (RLI), looking at institutional investor sentiment toward private equity fundraising in 2022/23.

Nordic Capital closes Fund XI on €9bn

Nordic Capital has announced the completion of Nordic Capital Fund XI, the firm’s largest fundraise to date.

Three Hills Capital Partners closes fourth fund at hard cap of €1 billion

Three Hills Capital Partners has announced the final close of Three Hills Capital Solutions IV at its hard cap of just over €1 billion.

VIDEO: Adapting to market developments - BVCA Summit 2022

What does it take to build a market-leading GP in today's environment? And what is Nordic Capital doing to ensure it stays ahead of the curve as markets change and adapt?

Rede named Placement Agent of the Year at 2022 Unquote Awards

We are incredibly proud to have been awarded Placement Agent Of The Year at the Unquote British Private Equity Awards.

Magnus Goodlad and Mike Camacho recognised in The Drawdown Most Influential Fund Finance Experts 2022

We're delighted that Magnus Goodlad, Partner, and Mike Camacho, Principal, have been named in The Drawdown ‘Most Influential Fund Finance Experts 2022.

Zetland Capital close second fund at €620m

Zetland Capital LLP, a leading European mid-market special situations investor, is pleased to announce the successful closing of Zetland Special Situations Fund II and associated vehicles, raising over €620 million.

Synova V holds first and final close at £875 million hard cap

Synova LLP (or ‘the firm’) has announced the first and final close of Synova V (or ‘the fund’) at the hard cap of £875 million, in just three months.

Asian entries

In this article Rede's Head of Asia, Charles Wan, discusses the evolution of placement agents in the Asian market.

PUBLICATION: Rede Private Credit Report

We are delighted to publish the inaugural Rede Private Credit Report, identifying key trends within the asset class and examining LP sentiment towards a variety of private credit themes and strategies.

VIDEO: Gabrielle Joseph explains the findings of the Rede Liquidity Index (RLI) 1H 2022.

We are pleased to announce the publication of the 9th edition of the Rede Liquidity Index (RLI), looking at institutional investor sentiment toward private equity fundraising in 2022.

PUBLICATION: Rede Liquidity Index 1H 2022 Report

We are pleased to announce the publication of the 9th edition of the Rede Liquidity Index (RLI), looking at institutional investor sentiment toward private equity fundraising in 2022.

Democratisation in private equity: Adam Turtle and Gabrielle Joseph talk to Real Deals

The increased number of retail investors dipping their toes into alternative assets could have a positive impact on the public’s perception of private equity in the long term.

FPE Fund III surpasses target, closing at a hard cap of £185m

FPE Capital LLP (‘FPE’ or the firm), the software & services focused lower mid-market growth investor, has announced the successful final closing of its third fund (“FPE Fund III” or “the Fund”), with investor commitments of £185 million (US$ 235 million).

Ian Flavell named in Private Equity International's Future 40

We are delighted to announce that Rede's Head of Americas Advisory Ian Flavell has been named one of Private Equity International's Future 40.

RedeConnect 2022: videos and materials

RedeConnect 2022 took place over 26-28 April. With over 650 registrants, the programme included six webinars presented by the Rede senior team and a number of high-profile guest speakers from across our GP and LP network.

Circularity European Growth Fund II closes at an extended €215 million hard cap

Circularity Capital, the circular economy growth investor, has announced the oversubscribed final close of its second fund at €215 million.

Rede Partners opens Hong Kong office and appoints Charles Wan as Head of Asia

Rede Partners, a leading independent fundraising advisor to the private markets, has opened a new office in Hong Kong and appointed Charles Wan as its regional head.

Rede Liquidity Index 2H 2021Report

We are delighted to release the 8th edition of the Rede Liquidity Index (RLI), our research that looks at institutional investor sentiment towards private equity for the second half of 2021 and into 2022.

Verdane closes impact fund Idun at hard cap of €300m

Verdane, the European specialist growth equity investor, has announced that it has held a final close on Verdane Idun I (“Idun” or “the Fund”), an impact-focused fund investing in technology-enabled businesses based in Northwestern Europe.

Rede in review

2021 was a landmark year for Rede Partners, marking a decade since our firm was founded.

Outlook for private equity in 2022

Adam Turtle joins leading industry members as they share their 2022 predictions for the annual Private Equity News outlook.

Adam Turtle named in FN50 Most Influential People in European Private Equity

We're delighted that our Co-Founder and Partner, Adam Turtle, has been named as one of 50 Most Influential in European Private Equity by Private Equity News.

Why LPs are investing in food for impact

Jeremy Smith, Head of Impact, joined New Private Markets recently to explore how food and agriculture investment fits into LP portfolios and why many are looking to increase their exposure in the area.

Private equity firms’ $714bn in dry powder set to surge even higher in 2022

Gabrielle Joseph, Head of Origination and Due Diligence, was recently invited to comment on the fundraising environment and rising dry powder in the market in an article for Financial News.

Monterro announces the first and final close of Monterro 4 at €700m

Monterro, a leading B2B software growth investor in the Nordics, has today announced the first and final close of its fourth fund (‘M4’ or ‘the Fund’) at €700 million.

A fireside chat with tcv partner john doran

At this year's virtual BVCA Summit, Kristina Widegren had the privilege of interviewing Rede client John Doran, Partner at TCV, about TCV's approach to investing in technology.

Rede named Placement Agent of the Year at the Unquote British Private Equity Awards

We are incredibly proud to have been awarded Placement Agent Of The Year at the Unquote British Private Equity Awards.

Thomas H. Lee Partners announces final close of Fund IX at its hard cap with $5.6 billion in capital commitments

Thomas H. Lee Partners, L.P. ("THL"), the US-based private equity firm investing in middle-market growth companies, has announced the successful final close of its ninth flagship fund

Agents of change - Gabrielle Joseph talks to PEI

Gabrielle Joseph contributes to this in-depth analysis with PEI, exploring the role of a placement agent and how this has changed over recent years.

In conversation with... Adam Turtle joins the Unquote Podcast

In this podcast Adam Turtle joins Greg Gille to discuss the first decade of Rede Partners and the main trends in European fundraising night now.

Rede named Placement Agent of the Year at the Real Deals Private Equity Awards

We are incredibly proud to have been awarded Placement Agent Of The Year at the Real Deals Private Equity Awards.

The Future of Private Equity: Five Predictions for the Next Decade

In the 10 years since Rede Partners was founded, there has been considerable change in the world at large, as well as in the private markets space.

Timings of a fundraise - Gabrielle Joseph discusses

Timing is key when a GP chooses to raise a fund and getting this wrong can have serious consequences.

GHO Capital announces final close of Fund III at over €2 billion

GHO Capital (Global Healthcare Opportunities), the European specialist investor in global healthcare, has announced the final close of its third fund

Apax Partners closes Apax Midmarket X at €1.6bn, oversubscribed and at hard cap

Apax Partners has announced the final close of its tenth midmarket fund, Apax Midmarket X (or the “Fund”), at €1.6 billion surpassing its €1.2 billion target.

Private Equity Trendspotter: Exhausted dealmakers brace for another wave of sponsor-led deals

The first half of 2021 has seen record transactions take place, showing that the demand for private equity deals has recovered quickly from Covid-19.

Nordic Capital raises €1.2 billion for Evolution, its first mid-market fund, in a record three months

Nordic Capital has announced the successful first and final close of its first Evolution Fund at just over €1.2 billion (including GP commitment of 6.8%).

Intera Partners Closes Fund IV at €335m in three-month fundraise

Intera Partners, the Finnish growth-orientated private equity firm, has today announced the first and final close of its fourth fund (Intera Fund IV) at €335 million.

Why we decided the placement agent model needed to change

Rede Partners celebrated its 10th birthday in 2021. To mark the occasion founders Adam Turtle and Scott Church were invited to reflect on the first decade of the business and share what they’ve learnt.

'Same names, new funds' Adam Turtle speaks to Real Deals

New market segments, new strategies, new verticals. As PE houses evolve to attract new and existing LP allocation it appears that diversification is a way to reach capital.

Rede Liquidity Index 1H 2021Report

We are delighted to publish this report, the 7th edition of the Rede Liquidity Index (RLI), looking at institutional investor sentiment towards private equity (PE) for the first half of 2021 and into the remainder of the year.

Preparing the next raise: how to be ready to market to institutional investors?

At the recent BVCA Emerging Managers Workshop, Gabrielle Joseph, Head of Due Diligence and Client Development, joined Matt Dickman, Debevoise & Plimpton, Carolina Espinal, HarbourVest and Alan Mackay, GHO Capital for an insightful discussion.

How to balance the interests of stakeholders when setting up a continuation fund

Magnus Goodlad, Head of Transactions at Rede, recently contributed to a GP Workshop in Real Deals focussing on setting up continuation funds and how to keep the interests of stakeholders balanced.

The state of private markets sustainability in five charts

Jeremy Smith, Head of Impact, recently contributed to ‘The state of private markets sustainability in five charts’ for New Private Markets.

Standardise impact data to unlock trillions

In the recent article ‘Standardise impact data to unlock trillions’ Jeremy Smith, Head of Impact Investing at Rede, examines the megatrend.

PAI Partners close debut mid-market fund at €920m

PAI Partners (“PAI”), a leading pan-European private equity firm, has announced the successful final close of its inaugural PAI Mid-Market Fund (“PAI MMF”, or the “Fund”) with a total of circa €920 million of commitments.

Verdane closes Edda II fund at €540m hardcap

Verdane, the European specialist growth equity investor, has announced that it has held a final close on Verdane Idun I (“Idun” or “the Fund”), an impact-focused fund investing in technology-enabled businesses based in Northwestern Europe.

Private Equity Global Outlook 2021 - The Fundraising Environment

Adam Turtle was invited to take part in the Private Equity Wire annual Global Outlook Report, and share his thoughts on fundraising trends.

TCV closes TCV XI at $4 billion

TCV announced this week the closing of TCV XI, the firm’s largest fund to date at $4 billion.

Volpi Capital beats target with second fund holding final close at €323m

Volpi Capital, the London-based mid-market tech investor, has announced the final close of its second fund at €323 million (excluding co-investments) surpassing its €300 million target.

Who’s raised the largest long-term funds? Adam Turtle speaks to PEI

Long-term funds are now seen as an asset class of their own by some - raising over $50bn since 2016.

The case for NAV-based lending - Magnus Goodlad in Secondaries Investor

Magnus Goodlad, Head of Transactions at Rede, was recently invited to discuss the virtues of NAV-based lending by Secondaries Investor.

Rede in review

As 2020 nears conclusion and this challenging year draws to a close, we wanted to look back at the achievements and hard work of our team.

alexandra bazarewski listed in wall street journal ‘women to watch’ list

We are delighted to announce that Rede Principal Alexandra Bazarewski has been named one of Wall Street Journal’s ‘Women to watch’.

CBPE closes Fund X at £561 million hard cap

CBPE Capital LLP (“CBPE”) has announced the final close of its latest fund, CBPE Capital Fund X.

EMH Partners closes Fund II at €650 million hard cap

EMH Partners (EMH) has announced the successful final close of EMH Growth Fund II (the Fund) at €650 million (excluding co-investments).

Rede Liquidity COVID-19 Pulse Report Q3 Update

Between March 2020 and July 2020, Rede Partners issued six COVID-19 Pulse Reports, providing flash insights into LP behaviour and sentiment in response to the rapidly evolving Coronavirus pandemic.

VIDEO: Building The PE Firm Of The Future

At this year's virtual BVCA Summit, Kristina Widegren had the privilege of interviewing Rede client Matthew Brockman, Managing Partner at Hg, about Hg's approach to building the GP of the future.

Nordic Capital closes €6.1bn Fund X in less than six months in wholly remote capital raise

Nordic Capital has announced the successful final close of Nordic Capital Fund X (“Fund X” or “the Fund”), at €6.1 billion (including GP commitment of 6.5%).

Rede Partners launches 2021 Graduate Scheme

Today we officially launched our 2021 Graduate Scheme for students and recent graduates looking to begin their Private Equity career journey.

Hg closes three funds at $11 billion in aggregate: Hg Genesis 9, Hg Mercury 3 and Hg Saturn 2

Rede Partners has announced that it has advised leading global software investor Hg on its latest fundraisings totalling $11 billion USD across three vehicles.

Rede Partners appoints Eric Ellul as Chairman alongside two senior hires

Rede Partners, a leading independent fundraising advisor to the private equity industry, is pleased to announce the appointment of Eric Ellul as Chairman[1] alongside two new senior hires.

Secondary market update: coming out of hibernation

The pick-up in activity is noticeable on the GP-led side. Many private equity houses postponed exits and are now looking for continuation vehicles and fund extensions.

We are delighted to be shortlisted for ‘Placement Agent Of The Year’ by the Unquote British Private

A public vote determines the final winner and we would greatly appreciate your support. Voting is open now and closes on Wednesday 16th September.

LPs commit to PE despite uncertainty, but not all funds reap the benefits

Scott Church, Founding Partner, spoke with S&P Global about the impact of COVID-19 on private equity fundraising, including the surprising trend for some fundraises to have accelerated during the pandemic.

Jonathan Hartland named in Private Equity International's Future 40

We are delighted to announce that Rede Principal Jonathan Hartland has been named one of Private Equity International's Future 40.

How to handle portfolio company management in a GP-led deal

The GP has worked with the company, very often with that management team, for a number of years. That knowledge and experience is part of what de-risks the transaction.

Activant Capital closes third fund with $257m in commitments

Activant Capital, the growth equity fund manager, has announced the final close of its third fund with commitments of $257m to invest in commerce infrastructure technology.

Rede Partners becomes Level 20 supporter

We’re delighted to be one of the supporters of Level 20, the not-for-profit organisation established to inspire women to join and succeed in the private equity industry.

Increased private equity interest in performance fees over return levels

Magnus Goodlad, Head of Transactions at Rede, was recently invited to discuss the virtues of NAV-based lending by Secondaries Investor.

Stirling Square Capital Partners raises €950m for Fourth Fund

Stirling Square Capital Partners has announced the successful final close of its Fourth Fund with €950 million in total commitments raised.

Rede Partners launches Graduate Scheme

Today we officially launched our Graduate Scheme for students and recent graduates looking to begin their Private Equity career journey.

Continuation funds are here to stay, now what?

At Rede, the first thing we do before embarking upon any transaction is a 360-degree stakeholder analysis. GPs and LPs take centre stage in continuation fund projects, but the interests of other parties must also be considered.

GP equity deals still a key gear driving the private markets engine

As with the portfolio companies you are investing in, as a GP you don’t want to shut your eyes and take the highest price. Rather, decide who is the best long-term partner for the firm.

Rede Partners appoints Magnus Goodlad as Head of Transactions

Rede Partners, a leading independent fundraising advisor to the private equity industry, is pleased to announce the appointment of Magnus Goodlad as Head of Transactions.

The latest RLI results 2H 2019 in two minutes

How are LPs responding to the macro changes in the private equity fundraising market?

BlackFin Capital Partners closes third fund after raising nearly €1bn in largest European fund dedicated to asset-light financial services

BlackFin Capital Partners, the European specialist financial services investor, announced the successful final close of its third fund, BlackFin Financial Services Fund III at its hard cap of €985 million.

Adam Turtle named in Europe's 50 Most Influential People in Private Equity 2019

We're delighted that our Co-Founder and Partner, Adam Turtle, has been named as one of 50 Most Influential in European Private Equity by Private Equity News for the second year running.

Rede Liquidity Index 2H 2019 Report

LP liquidity is holding up in the face of macro headwinds with continued growth in deployment expected.

GHO Capital's biggest European healthcare fund in context

GHO Capital Partners has raised the largest Europe-focused healthcare fund this week with a €975 million haul for its sophomore vehicle.

GHO Capital raises €975m in largest ever European healthcare fund

GHO Capital Partners LLP, the European specialist investor in healthcare, has announced the final close of GHO Fund II LP at its hard cap of €975m.

Out of the grey zone into the comfort zone

Despite booming private credit activity, a bifurcation of in-vogue strategies until recently created a fundraising graveyard for approaches in the middle of the risk/return spectrum.

Miura closes Frutas, the largest agribusiness fund in Europe, to support the growth of Citri&Co and Frutas Esther

Congratulations to Miura Private Equity on raising c. €350 million for Frutas, the largest agribusiness fund in Europe.

Scott Church interviews Ambienta's Nino Tronchetti Provera and Synova Capital's David Menton at the BVCA Summit

Rede Founding Partner Scott Church hosted the 'Fireside Chat' at this year's BVCA Summit in London. He was privileged to interview two Visionaries.

Rede Partners named as Placement Agent Of The Year by Unquote British Private Equity Awards

Rede Partners is incredibly proud to have been awarded Placement Agent Of The Year at this year's Unquote British Private Equity Awards.

Secondaries pricing: Behind the NAV

Yaron Zafir, Head of Secondaries at Rede Partners, talked to Private Equity International about secondaries pricing and the influence of buyers and sellers’ expectations on transaction volumes.

Mike Camacho named in Secondaries Investor' Young Guns of Secondaries 2019

Rede congratulates Principal Michael Camacho on being named in Secondaries Investor's 'Young Guns of Secondaries'.

Buyouts' GP-stakes bet raises concerns

There is a huge amount of value being created at the GP-level of many successful private equity firm and that value is not necessarily shared in by the investors in the funds.

Three Hills Capital Partners announces €192m secondary transaction

Three Hills Capital Partners has announced the closing of a €192m GP led secondary transaction, involving the creation of two new funds, to raise fresh capital from new institutional investors for some of the firm’s high growth portfolio assets.

Wisequity V closes at hard cap of €260m

Wise Equity (“Wise”), a leading investor in the Italian lower middle market, has held a first and final close for its fifth fund at its hardcap of €260m less than two months post launch.

Kristina Widegren promoted to Partner

We are delighted to announce the promotion of Kristina Widegren to the role of Partner, joining co-founders Scott Church and Adam Turtle in the firm's partnership.

Amadeus Capital Partners announces new partnership with HarbourVest Partners to support Digital Prosperity Fund I in $87m secondary

In a transaction totalling $87 million, MTN Group, the South Africa‐based telecommunications company, has sold its interest in Digital Prosperity Fund I and an allied co‐investment vehicle for TravelStart Group, both managed by Amadeus Capital Partners, to HarbourVest.

Blackstone becomes latest blue-chip manager to tap secondaries market

Within these transactions, the acquiring vehicles typically pay lower fees and carried interest to the GP than the standard 2 and 20 percent respectively that a third-party GP would take.

Sabrina Malpas named in Private Equity International's Future 40

We are very proud to announce that Rede Principal Sabrina Malpas has been named one of Private Equity International's Future 40.

Rede Partners wins Placement Agent Of The Year at the Private Equity Awards 2019

Rede Partners is delighted to announce that it has been recognised as Placement Agent Of The Year by the British Private Equity Awards 2019.

Private equity basks in 'golden age' of returns

If you have a fund where the the investment period was characterised by modest investment multiples and then you have a hot and attractive exit market when the company matures, you are able to create a high internal rate of return, with the stars aligned for some outstanding performers.

Making hay: European buyout fundraising

Private equity firms are upping fundraising sizes and pushing hard on terms as managers prepare for a change of fortune.

Private equity clients turn to co-investments to reduce costs

Some 96% of 166 limited partners surveyed by Rede Partners say that they expect to increase or maintain allocations to co-investments.

Watch our two minute summary video to understand the latest RLI results

What's driving the changes we're seeing in the private equity fundraising market?

Rede Liquidity Index H1 2019 Report

Slowdown in growth expected for private equity as the RLI drops below 60 for the first time, driven by a downswing in sentiment amongst North American investors. Read the full RLI Report for 1H 2019.

Summa Equity closes its Fund II with SEK 6.5 billion to invest to solve global challenges

Summa Equity announced today that it has raised further capital to continue to invest to solve global challenges. Summa Equity Fund II closed at hard cap with investor commitments of SEK 6.5 billion (c. EUR 610 million).

Secondaries buyside professionals cross to advisory

Rede Principal Michael Camacho spoke with Private Equity International about his move to the Rede Transactions & Secondaries team after a decade on the buyside.

Three Hills Capital Partners announces final close of Three Hills Capital Solutions III at €540m

Three Hills Capital Partners have announced the final close of Three Hills Capital Solutions III at €540m - significantly in excess of the original target of €400m and close to three times higher than its prior fund.

Verdane to invest SEK 6 billion in Northern European growth companies

Verdane, the European specialist growth equity investor, has announced that it has held a final close on Verdane Idun I (“Idun” or “the Fund”), an impact-focused fund investing in technology-enabled businesses based in Northwestern Europe.

2019 in Europe: Big funds and Brexit bargains

Rede Principal Kristina Widegren caught up with Private Equity International to discuss the outlook for PE fundraising in 2019.

PEI's story of the year 2018 - Lyceum Capital's Rebirth

Rede's work with Lyceum Capital / Horizon was featured as "Private Equity International's Story Of The Year 2018"

PEI's story of the year 2018 - Lyceum Capital's Rebirth

Rede Principal Kristina Widegren caught up with Private Equity International to discuss the outlook for PE fundraising in 2019.

Rede partners shortlisted in four categories for the pei awards 2018

After a record-breaking year for us at Rede Partners we're thrilled to have been shortlisted in three different categories for the prestigious Private Equity International Awards 2018.

Adam Turtle named in Europe's 50 Most Influential People in Private Equity

We're delighted that our Co-Founder and Partner, Adam Turtle, has been named as one of 50 Most Influential in European Private Equity by Private Equity News for the second year running.

Single asset transactions afford a slow and steady pace

When a fund approaches the end of its lifespan before the optimal exit window emerges for its remaining asset, transferring the single portfolio company into a new vehicle is proving increasingly popular.

VIDEO: Finding your edge

Scott Church, Partner at Rede Partners moderating a fireside chat at the BVCA Summit 2018, held at The Landmark, London on the 11 October 2018.

Who really benefits from single asset transactions?

Who really benefits from single asset transactions? Rede's Head of Secondaries and Transactions Yaron Zafir recently wrote this guest editorial for Secondaries Investor magazine.

Launch of Horizon Capital and close of £200 million bridge fund

Launch of Horizon Capital and close of £200 million bridge fund. Horizon 2018, a seven-year investment vehicle has held a final close on £200 million.

Hg announces final closing of Hg Saturn 1 Fund at £1.5bn

Hg has announced the final close on its Hg Saturn 1 Fund (“Saturn”), a software‑focused, large‑cap European buyout fund, at its hard capitalisation raising a total of £1.5 billion.

Secondaries sentiment down amid bright H2 picture

Following the launch of the Rede Liquidity Index (RLI) for 2H 2018, Adam Turtle, Founding Partner of Rede, caught up with Private Equity International to discuss the findings.

Rede Liquidity Index 2H 2018 Report

Private equity is still in growth mode as 90% of LPs surveyed for the 2H2018 Rede Liquidity Index (RLI) say they expect to increase or maintain existing allocations over the next year, despite a slight dip in UK investor sentiment

Rede congratulates Associate Principal Julie Prewer on being named in Secondaries Investor's 'Young Guns of Secondaries 2018'

Over her seven year tenure with advisory firm Rede Partners Julie has proved a dab hand at GP-led transactions with one source describing her as “a force to be reckoned with."

Rede hires industry veteran, strengthens senior team

Rede Partners has appointed industry veteran Ian Simpson as a senior adviser, building on a series of other hires made earlier this year.

Challenging 'fake diversity' and the ongoing lack of senior women in private equity

Gabrielle Joseph, Rede's Head of Due Diligence and Client Development, spoke with AltAssets about the role of gender in private equity and gave her view on how the industry can make positive strides to tackle its diversity challenges.

Apiary Capital Closes First Fund at Hard-Cap with commitments of £200m

Apiary Capital, today announced the final close of its debut fund, Apiary Capital Partners I.

Fundraising Declines Amid Split Between Haves and Have-Nots

Recent data has revealed that the amount raised for buyout strategies fell 24% to $44.5 billion in the first six months of this year.

US Private Equity Funds Look Abroad

Rede co-founder Adam Turtle recently caught up with PEI to discuss the increasing trend of US PE funds becoming more internationalised to tap into markets they deem less competitive.

Rede Partners to strengthen its North American presence with Co-Founder Scott Church relocating to New York

The move, set to take place in August, will see Scott continue the firm’s international expansion following the opening of a dedicated New York office in 2017.

Are LPs warming to platform extensions?

Rede founding partner Adam Turtle recently caught up with PEI to discuss growing investor appetite for platform extensions.

Ambienta closes €635m Fund III – the largest private equity fund focused on environmental investing

Rede Partners congratulates Ambienta on the successful €635 million close of Ambienta III at its hard cap after just three months of active marketing. The Fund was heavily oversubscribed.

Volpi Capital announces the final closing of its first institutional fund

Rede is delighted to have advised Volpi Capital on its fundraising for its inaugural fund, Volpi Capital Fund I, which closed on its hard-cap of €185m.

Ask a Fundraiser

Rede founding partner Adam Turtle recently spoke with PEI on some of the well-known industry nightmares managers can come across while raising a fund.

Rede Co-Founders named on PEI’s ‘Rainmaker 50’ list

Rede Partners’ co-founders Scott Church and Adam Turtle have been named on a list of private equity’s most influential fundraisers, compiled by Private Equity International.

PAI Partners announces close of PAI Europe VII at €5bn hardcap

A huge congratulations to PAI Partners who have today announced the €5bn close of PAI Europe VII.

Verdane to invest sek 3 billion in nordic high-growth companies

Rede would like to congratulate Verdane on the highly successful SEK 3 billion close of Verdane Edda. The Fund was heavily oversubscribed and closed at its hard cap, with a global LP group.

PUBLICATION: Rede Liquidity Index 1H 2018 Report

Strong momentum in the private equity industry is set to continue as LPs expect to allocate even more to the asset class over the next 12 months.

Rede Partners named ‘Placement Agent of the Year in Europe’ at 2017 Private Equity International Awards

Rede Partners is proud to have been named ‘Placement Agent of the Year in Europe’ at the 2017 PEI Awards, hosted by Private Equity International.

Miura Private Equity closes its third fund at €330m hard-cap

Rede Partners is pleased to have advised Miura on the raising of its third fund – Miura Fund III – at its hard-cap of €330 million.

Fundraising hit record high in 2017

Secondaries fundraising across private equity and real estate hit a record high last year, according to PEI data.

Looking ahead: Europe in 2018

At the turn of another year, many are speculating on what is likely to shape the European private equity landscape in 2018.

Alchemy closes Special Opportunities Fund IV at £900m hard-cap

Rede Partners is delighted to have advised Alchemy on the successful close of its Special Opportunities Fund IV at its £900m hard cap.

Perspectives 2018: Paying the price

What matters for LPs? Adam Turtle, Co-Founder and Partner at Rede spoke with Private Equity International about the key concerns of investors following their annual survey of LPs.

FPE Capital announce £100 million final close of first institutional fund

Rede Partners is pleased to have advised FPE Capital on its £100 million fundraising for its first institutional fund, FPE Capital II.

Investor appetite for Private Equity remains high with increased commitments to the asset class expected in the year ahead – H2 2017 RLI

Rede Partners today releases the H2 2017 Rede Liquidity Index (RLI), the industry benchmark which aims to assess underlying investor sentiment as an indicator of the health of the private equity sector.

Rede Liquidity Index – Press Release

Investor appetite for Private Equity remains high with increased commitments to the asset class expected in the year ahead.

European PE Taps Demand for Healthcare Investments

With increased interest in healthcare, co-founder, Adam Turtle, spoke to Private Equity News about the strengths of the sector and why it’s attractive for LPs and sector specialist managers alike.

Scoring sentiment: Rede’s Zafir on aged primaries and liquidity

Secondaries Investor recently caught up with Yaron Zafir, head of secondaries, about the findings of the Rede Liquidity Index report.

Fundraising special: How to raise a first-time fund

Adam Turtle, co-founder of Rede Partners, spoke with Private Equity International to share his thoughts on what is required for a successful first time fund in today’s highly competitive environment.

Apax Partners MidMarket announces the final closing of Apax France IX at €1bn hard-cap

Rede Partners is delighted to have advised Apax Partners MidMarket on its €1 billion fundraising for its ninth fund, Apax France IX.

Adapt to survive

As the private equity world has become more diversified and complex, Greg Gille of unquote explores how placement agents have evolved to exploit new opportunities and overcome their specific challenges.

Why is private equity surviving the storm?

This week, the Rede Liquidity Index (RLI) has revealed that private equity investors plan to deploy more capital into the asset class in 2017 than they did over the past 12 months.

Rede Partners launches inaugural Rede Liquidity Index: Investment into Private Equity set for further growth

Rede Partners, today unveils its new industry benchmark, the Rede Liquidity Index (RLI). The RLI aims to assess underlying investor sentiment as an indicator of the health of the private equity industry.

Summa Equity announce SEK 4.5 billion final close of first fund at hard cap

Summa Equity today announces that its first fund, Summa Equity Fund I, has closed with commitments of SEK 4.5 billion, exceeding the initial target of SEK 3.3 billion after being significantly oversubscribed. The fund size was limited to SEK 4.5 billion despite oversubscription.

HgCapital 8 and Mercury 2 both reached their hard cap raising a total of c. £3.1 billion

Rede Partners is delighted to have advised HgCapital on the fundraising of its two latest funds, HgCapital 8 and Mercury 2.

£60m final close for Elaghmore's first fund

Rede Partners is pleased to have advised Elaghmore Partners on its £60m fundraising for its first fund, Fund I. The fund closed at hard cap following a highly focused three month process and has already made its first investment with the acquisition of SB Components.

Fund placement: When money is not enough

Placement agents can no longer get by with just introducing managers to sought-after LPs, according to Rede Partners’ Adam Turtle and Scott Church in this article from Private Equity International.

Three questions with Rede’s Yaron Zafir

Amid the emergence of managers specialising in GP-led deals, advisors are still vital in a complex sector with inherent conflicts of interest

GHO announce €660 million final close of GHO Capital Fund I LP at hard cap

Rede Partners is pleased to have advised GHO Capital on its €660 million fundraising for its inaugural fund, GHO Capital Fund I LP, at its hard cap and considerably above its target of €500 million.

Verdane Closes on SEK 3 billion in under 3 months

Verdane Capital IX AB (Verdane IX) has closed at its hard-cap with SEK 3 billion in commitments. The fund, which is Verdane’s largest to date, was significantly oversubscribed.

Wisequity Fund IV on closes on €215m hard cap

Wise SGR Board of Directors are pleased to have accepted this morning total commitments of €215 million for its Wisequity IV Fund equating to the hard cap of the Fund.

Stirling Square Collects €600m for Latest Fund

Stirling Square Capital Partners, a leading private equity investor in the European mid-market, announces the final closing of its Third Fund at its hard cap of €600m.

CVC buys £400m stake in Moto service stations

The Financial Times references the findings of Rede Partners' latest LP survey on the return expectations of private equity investors.

What returns LPs are expecting from managers

Real Deals reports on the findings of Rede’s latest LP survey.

Four tips for private equity fundraising

Adam Turtle, Partner at Rede Partners, discusses the challenges posed by AIFMD to middle-market fund managers with Capital.

Solvency II: the next big driver of deal flow in Europe

Yaron Zafir, Principle at Rede Partners, discusses the increasing focus of insurance companies and pension funds on the secondaries market in Secondaries Investor.

More firms look for alternatives as bank finance dries up

Scott Church, Partner, comments on debt capital fundraising and the European credit landscape in The Times.

Rede Partners Doubles Team Size to Meet Growing Demand

Rede Partners (“Rede”), the fundraising and secondaries advisory firm, has expanded its team from 10 to over 20 people since the beginning of last year.

PAI Europe VI closes at €3.3 billion

PAI has a long and successful track record of investing in market-leading European companies with a focus on companies headquartered in Continental Europe.

Ambienta closes environmental Fund II on just over €323m

Italian private equity firm Ambienta has beaten the $300m target for its second clean services-focused fund and closed ahead of schedule on €323.5m.

Paragon raises €412m for second mid-market fund

Paragon Partners is pleased to announce the closing of the Paragon Fund II at €412 million, significantly above its initial target.

Rede Partners grows secondaries capabilities

Rede Partners, the placement and advisory firm, has appointed ex-Paul Capital vice-president Yaron Zafir as a principal focusing on secondaries

Motion Equity Partners signs deal with Harbourvest

European buyout firm Motion Equity Partners has been given a new lifeline by HarbourVest Partners in a major fund restructuring deal.

The year ahead: fundraising shows signs of growth

Something happened over the summer and into September when Europe came off investors’ embargo list.

Paradise Lost?

Adam Turtle, Founding Partner of Rede Partners, spoke to RealDeals about fundraising in emerging markets.

Private Equity Awards 2013 – The winners

These four profiles demonstrate what it takes to snag the most coveted awards in the industry.

AnaCap hits £350m hard cap for Distressed Debt Fund

London based credit investor AnaCap Financial Partners has hit its £350m hard cap for its latest distressed debt fund, and was oversubscribed after six months of fundraising.